Business insurance safeguards you against the day-to-day risks your company may face. Choosing the right cover can be a little daunting. At constructaquote.com, we’re here to give you the information you need to make the right insurance decision for you and your business.

We offer a range of business insurance dependent on the type of work you do. We provide protection against anything from accidentally knocking down a client’s wall to dealing with hardware failure from a cyberattack, or covering legal costs if an employee were to make a claim against you.

What would happen if disaster struck and you didn’t have the right cover to protect you? Your business could be left on the ropes, struggling to stay afloat with the considerable legal or damage costs you could potentially face.

Employers’ liability

If your business employs anyone, whether that’s a single person or 10, you are legally required to have employers’ liability insurance. The Employers Liability (Compulsory Insurance) Act 1969 requires you to have a minimum of £5 million in cover - but we include £10 million as standard.

For example; if an employee breaks an arm tripping over a loose wire and you’re deemed to be at fault, you will have to pay the employee compensation. If you don’t have employers’ liability insurance, this will come out of your own pocket. On top of this, for each day you are without the appropriate insurance, health and safety inspectors could fine you up to £2500. If you refuse to make your certificate of insurance available, you can be fined up to £1000.

Public liability is not required by law but it is wise that businesses who deal with the public have this cover. Not only will it protect you against property damage and claims against personal injury, but it would also demonstrate that you are a trustworthy business. For this reason, the minimum level of cover can range anywhere from £1 million - £10 million. This, of course, depends on the nature of the business itself.

For example; a plumber was almost drained of his finances when he installed a new sink in a bathroom. A pipe he had fitted became loose causing a leak which damaged the customer’s property. As he was at fault, he had to pay compensation but this was covered by his public liability insurance.

Professional indemnity insurance

If you’re a business that relies on giving professional advice – verbally or written - you have a legal duty to ensure that advice you give is valid, reliable and free of errors.

Some professional bodies require their members to have professional indemnity insurance. If you are not associated with a trade body but provide advice or plans, you should still consider being covered, just in case.

As an example; an architect makes a mistake in designing a customer’s extension. The architect would be liable for any compensation the customer is owed due to rectifying the error.

Commercial legal and tax investigation insurance

Commercial legal and tax investigation insurance is not essential but it would provide you with vital support should you come into a legal disagreement with an employee or a member of the public.

For example; should an employee take you to court for unfair dismissal, the legal expenses can be quite high and take up valuable company time. You would receive some compensation for loss of income while attending court and the fees would be covered by this insurance. If you are found to have unfairly dismissed an employee, the average award given as of 2017 is £16,543.

If you’re a van owner, by law, you need to have van insurance to be able to drive it on the road. The minimum level you must have is third party insurance but this only covers damage you cause to another person, vehicle or property. It’s worth considering comprehensive insurance if your van is essential to your business. This fully covers your vehicle and aims to provide a replacement whilst your van is in repair or until your claim is settled.

Whether your van is for personal or business use, you can choose the level of cover suited to your needs.

The everyday running of businesses today relies heavily on technology. Sensitive data, such as, personal details of yourself or your employees, could be at risk of a cyber and hardware attack. This means that you can’t afford to ignore the possibility of being hacked. Our cyber insurance provides cover should you suffer a data breach or loss of income because of a cyberattack. We also offer IT support should such an incident occur

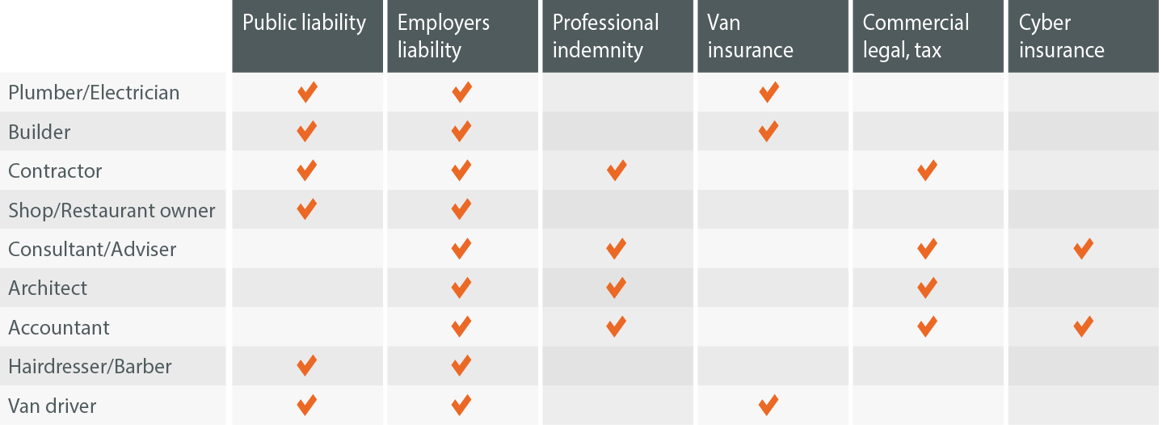

The type of business insurance you should consider and the level of cover necessary will depend on your individual circumstances – the type of work you do, the number of people you employ and even how you store customer information could all influence your decision. The table below displays the popular products available to each trade but the combination of products you purchase is up to you!

If your trade isn’t mentioned, call us on 08081 68 68 68 and we’ll be happy to point you in the right direction.

We also offer additional cover available for:

Having been established in 1990, constructaquote.com specialise in providing small businesses and tradesmen with suitable insurance policies. This ensures businesses can continue to operate in a secure and respectable environment with income security, despite the risks that may arise.

Don’t just take our word for it - check out our Feefo page to see what our customers have said about our service.

At constructaquote.com, we have insurance policies to suit almost everyone, giving you the best options available. Call us on 08081 68 68 68, request a call back from our friendly staff or start your quote now.